It's Time to Rethink Corporate Services

How ServiceNow is Helping Overcome a Decade of Incrementalism

Background

The application environment supporting modern corporate services has become increasingly fragmented over the past few decades. Specialisations in finance, human resources, governance and procurement have emerged to better meet the growing demands of today's professionals.

Simultaneously, the application revolution, driven by mega trends like mobility and cloud computing, has led to the development of point solutions within an already complex business process environment.

Evidence of this kind of application fragmentation can manifest in several ways:

Rogue investments in new technologies

Frustrated employees struggling to complete their tasks

Expanding software portfolios requiring a growing share of tech investment

IT resources unable to keep up with demand for internal support

Increasing risk across the information asset portfolio, including cybersecurity concerns

Despite ongoing acquisitions, the original ERP vendors have struggled to keep pace, leaving many companies challenged to meet the needs of internal stakeholders.

Essential Points

Whether your organisation refers to it as corporate services or operates within a shared services environment, there is a core set of functions that support most business operations. Typically, these include finance, procurement, people and culture, legal and governance, and technology. For mid-sized organisations, the customer function is also crucial.

Common to these functions is their role in ensuring the smooth and efficient operation of the organisation. They all provide essential support services that enable the core business to effectively function.

Moreover, these functions often report to the same executive in the C-suite, be it the CFO, COO or some other CXO authority. This centralised reporting structure is designed to facilitate coordinated decision-making, strategic alignment, and efficient resource allocation across these critical areas and thereby enhance the organisation's overall performance and responsiveness to business needs.

Needless to say, not enough businesses ever reach this state.

But when these areas operate as a unified “business within a business” function, the entire business thrives. Why? Because internal process efficiencies are the lifeblood of any healthy organisation. It is a proven strategy: optimise the back office (make employees happy) to enhance the front office (make the customers happy).

Still not convinced? Let’s take the concept of lifeblood a step further and imagine a business as the human body. In medical school, first-year students are taught three critical tasks to keep the body alive:

Ensure air flows in and out of the body.

Ensure blood circulates around the body.

Ensure oxygen reaches the brain.

The third task depends on the first two. That’s it.

This is a perfect analogy for the desired functional state of corporate services within an organisation. Information must flow freely in and out of the organisation. It must circulate between all departments. And ultimately it must reach the brains of the organisation in a timely manner to allow reflexive and routine decisions to be made. In an anatomical scenario the consequences of these functions not occurring are dire. In a business sense, there is little difference.

We see it and experience it every day. Organisations trying to overcome the challenges of blocked information flows due to poorly integrated business applications. Information circulation hindered by both physical and virtual functional silos. Internal politics and bespoke software choices defended as tribally as football teams, yet ultimately obstructing the delivery of crucial information to the organisation's decision-makers.

Application Incrementalism

A significant contributor to this issue has been over a decade of moving away from core ERP systems that lacked specific capabilities, and moving towards adopting numerous highly specialised enterprise applications and mobile apps—a global period of application incrementalism.

The 2023 Singapore Fintech Festival was a great example of this with over 5,000 vendors displaying solutions across the broad financial ecosystem. This has been replicated in every corporate services function and sub-function that has ever existed, while new classifications continue to emerge every year.

This isn’t the application renewal world of 1999 or 2007, or even 2015.

In the 2020’s departments have not just moved away from a single core HR or Finance platform to something else. Instead, these once central and sacred core platforms are augmented to the point of being unrecognisable. Process hierarchies are broken and uncoupled. And the ability of “yet another solution” to provide the business with the information it needs to operate effectively or give employees the experiences they need to stay focused on their most critical customer tasks is further negated.

This approach has created more operational inefficiencies at a faster rate than whole industries have been able to manage, and not in small part because of the continual operational focus on addressing the symptoms and not the root-cause.

But just as fixing a blocked vein in the arm might provide some temporary relief from numbness, it will do little to improve a systemic aortic obstruction or collapsed lung. Organisations are sick and the bill from the clean up of frat party style application incrementalism is falling due.

Continuing with incremental fixes for what are systemic information and application problems across the corporate services portfolio will inevitably fail to create a healthy and habitable information environment for the organisation. Of course, just like the desire for personal wellness, there must be an inherent desire and capacity to change.

My Take

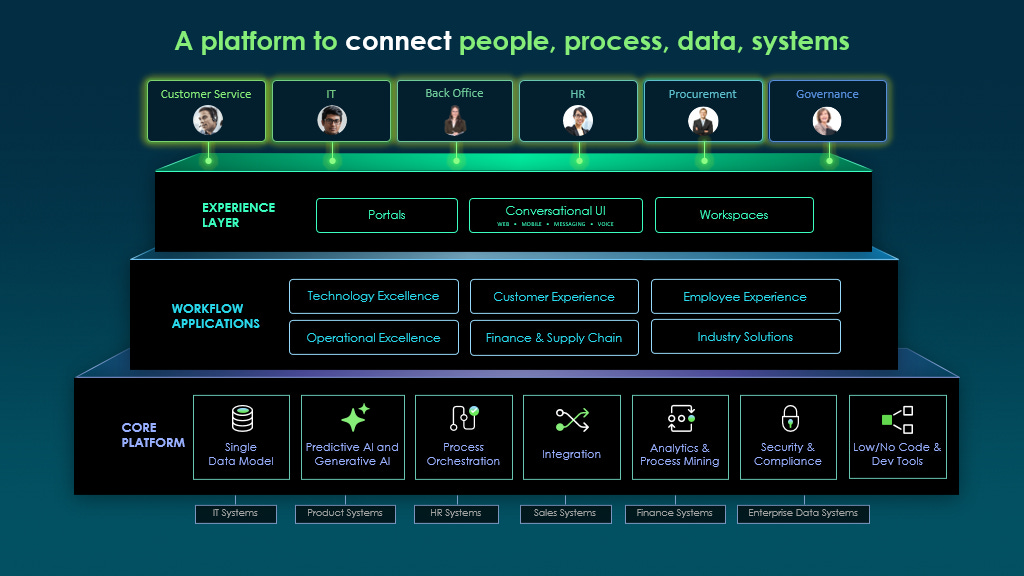

Rationalising the application portfolio can begin with corporate services. And why shouldn’t it? Achieving this via and within an AI-enabled PaaS environment that can expand across various business functions1 is a transformative opportunity that should not be overlooked.

While many customers outside the ITSM market may still struggle to recognise the opportunities that ServiceNow offers, and realistically, this will continue for some time, its capability to address this complex issue is significant.

If a strategic goal of your organisation is to reunite, reintegrate, and dramatically enhance all functions within the corporate services domain, or simply to begin the overdue process of business system rationalisation, ServiceNow currently provides a peer-less solution worthy of serious consideration.

ROLES: This opportunity is tailor made for Corporate Services decision-makers, especially those leaders with a balanced view of the integrated transformational potential of finance, people and technology. Traditional corporate services executives, with a finance-centric view, more intent on short-term cost minimisation in the technology portfolio, are likely to overlook the strategic potential to enhance their organisation's long-term financial performance.

BUSINESSES: Traditionally, ServiceNow has targeted organisations with 1,000 seats or more. However, there is compelling evidence to suggest, in the APAC region at least, that a well-packaged ServiceNow offering would significantly benefit the 500-seat plus mid-market in the APAC region. Afterall, to solve the problem you have to meet it head on.

This post is focused on the corporate services problem. But the functional and cross-functional challenges and consolidation opportunities extend across all areas of the business.